The world of entrepreneurship is one of excitement and fulfillment, but it's also (for better or worse) one of paperwork. As the owner of your own business, that's something you'll learn from day one.

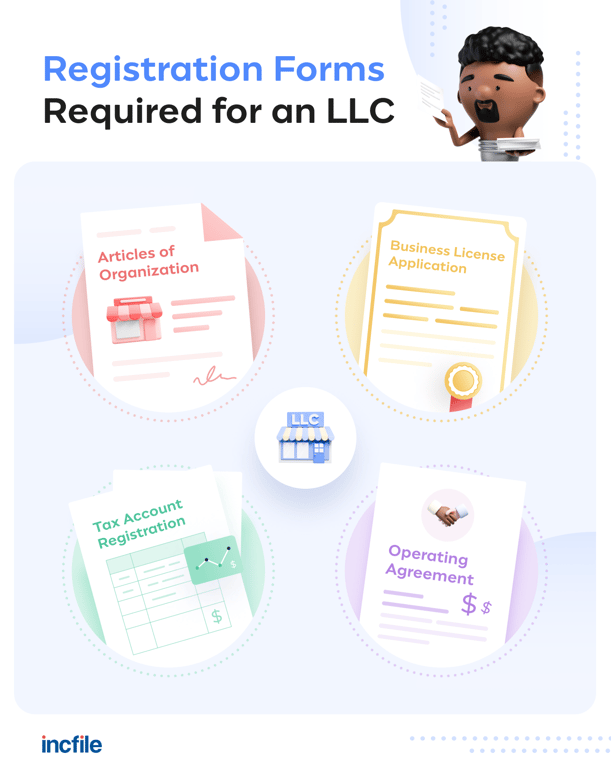

After all, it takes at least a couple of official registration forms to get an LLC up and running. From your Articles of Organization to your business license application, these are the forms you may need to contend with in order to open your LLC.

Registration Forms for LLC Formation

Wondering what documents you need to register a limited company? You can expect to file one or more of these LLC registration forms.

Articles of Organization

No matter what type of LLC you're starting, the Articles of Organization are non-negotiable. This is the document you're required to file with your Secretary of State, regardless of which state you live in.

Depending on the state you're in, the Articles of Organization may also be known as the Articles of Formation, Certificate of Organization, Certificate of Formation or a similar variation of those.

To find yours, you'll likely need to go to your Secretary of State's website. Then, you can typically locate a section of the site called "business services." From there, find the section containing LLC forms and download the Articles of Organization or your state's equivalent. (Note that some states keep their business forms gated behind an online portal, which you'll need to create an account to access.)

When filling out the form, you'll generally be required to provide the LLC's:

- Official name (make sure it's unique by performing a business name search ahead of time)

- Main office address and mailing address (if you don't want to receive business mail at your home, remember you can always set up a virtual mailbox)

- Registered Agent name, address and other contact information (if you don't already have a Registered Agent, you might want to use Incfile's affordable Registered Agent service)

- Management and member information

- Founding member information (that's you!)

Many states will allow you to file your Articles of Organization online, while some may require you to submit your form via the mail or in person.

No matter the method of submission, though, all states require a filing fee. In the cheapest states to form an LLC, that could mean as little as $40. But in others, it might cost several hundred dollars — it's all determined by your state's individual requirements and regulations.

Business License Application

Depending on the type of business you're opening (as well as the state, county and city you're opening it in), you may need to apply for a business license.

That could mean a general business license that simply allows your LLC to operate, or it could mean a specific license or permit that's tailored to your line of work.

Businesses that generally need to obtain special licenses and permits include:

- General contracting businesses

- Businesses providing electrical work, plumbing and other services involving skilled trades

- Restaurants and food trucks

- Construction and building companies

- Hair salons

- Auto mechanic shops

To find out how to get a business license in your state, you'll need to take a look at its individual requirements. Remember to check with your county and city government, too.

And if you'd like to make the business license application process as painless as possible, consider Incfile's Business License Research Service and let us track down all the necessary paperwork for you.

Business Tax Registration

Taxes are a fact of life, and that's just as true for small businesses as it is for individuals and large corporations.

As such, you'll need to register to pay business taxes when you open your LLC.

This is typically done through your state's Department of Revenue. On the form they provide, you'll likely need to include your:

- Reason for filing the form (first-time tax registration, renewal of tax registration, etc.)

- Type of organization

- LLC's name and contact information

- Proof of identification

- Principle and mailing address

- Sales tax account details

- Licensing information

You'll also need to pay any applicable fees when filing this form, which can vary based on the state your business is located in.

Don't forget about the federal government, either: If you plan on hiring any employees at your LLC (or opening a business bank account), you're required to get an Employer Identification Number (EIN) through the Internal Revenue Service (IRS). You can do so through the IRS directly, or you can use Incfile's EIN service to simplify the process.

Operating Agreement

While most states don't require LLCs to file an operating agreement, many require them to have one (or at the very least, strongly recommend it).

But regardless of whether or not your state requires you to have an operating agreement or not, you'll definitely want to create one when forming your LLC.

That's because an operating agreement acts as a roadmap that will inform the future of your LLC and make your decision-making process significantly easier.

In a complete operating agreement, you'll find things like:

- Clarification of verbal agreements

- Rules and regulations for how business will be conducted and what will happen to profits after they come in

- Details about what the owners, members and managers can and can't decide

- A plan for dissolving the LLC if and when the time comes, including how much of the company's remaining money will go to each member

- A plan for resolving conflict between the LLC's members

So no matter what kind of LLC you're starting or how many members it will have, an operating agreement can help pave the way for a bright future.

All Great Businesses Start with a Few Key Registration Forms

Doing paperwork might not be the most fun activity in the world, but it's a necessary step in getting your business off the ground. And once your LLC is up and running and you're living the entrepreneurial dream, we're sure you'll agree it's worth it.

Want to make the process of starting your business even easier? Let us do the paperwork for you. Our LLC filing service costs $0 plus state fees, so you have nothing to lose (and a thriving business to gain). File your LLC with Incfile today.