Are you considering growing your business by expanding to a new state? Congratulations! It’s a significant milestone in your company’s journey.

However, you can’t just grow your business without crossing a few Ts and dotting a few Is. In most instances, you’ll have to register in any new state in which you want to legally conduct business. This is known as foreign qualification and if you're expanding to new geographic regions, it's usually required.

In this blog, we’ll guide you through understanding what a foreign qualification is, why it’s a must for any growing business and how to go about getting one with Incfile's complete service.

What Is a Foreign Qualification?

Foreign qualification refers to the legal process you take to register yourself with the Secretary of State in the new state you wish to do business in. It ensures you are in compliance with the new state(s)’ business laws without having to reincorporate yourself every time. In simple terms, filing for a foreign qualification in a new state gives you permission to operate there legally.

Why You Might Need a Foreign Qualification

Foreign Qualification? But I'm not expanding to a new country, just a new state! Are you confused by the naming? We get it. In the business world, your business is considered "domestic" in its state of incorporation and "foreign" in any other state it wishes to do business in. So, a foreign qualification is required when you seek to grow your LLC or corporation into a new state.

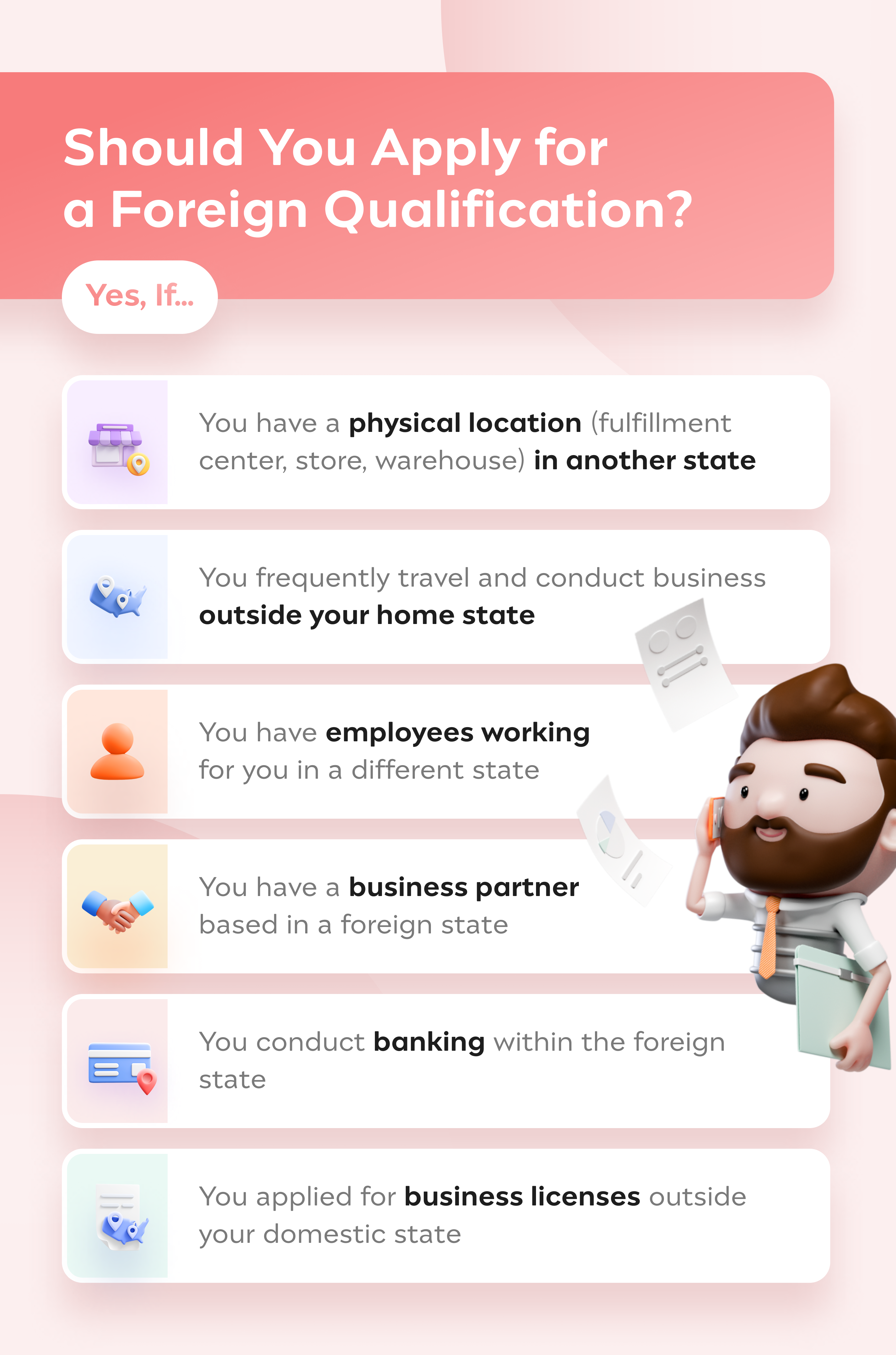

Here are a few scenarios where having a foreign qualification could be beneficial for you:

- Your restaurant business is incorporated and registered in Georgia. You want to open another location in Florida. You’ll be considered “doing business” in the new state as soon as you open doors to receive customers in Florida, so you will need to file for a Florida foreign qualification.

- You’ve incorporated in Delaware but wish to start a warehouse to stock the majority of your inventory in Virginia. You’d need a foreign qualification.

- You hired a remote employee that’s based in a state different from the one your business is incorporated in, and you are paying taxes there.

- A significant chunk of your business comes from another state. For example, the majority of your tax consulting client projects (i.e., revenue) are coming from Ohio, even though you’re incorporated in Indiana.

- You have a business partner who is based in another state and meet a lot of clients in that region.

The above are just a sliver of instances when a foreign qualification certificate is required; each state has different rules and requirements on what constitutes “doing business.” Furthermore, lines are easily blurred in today’s mobile and virtual environment, where an online business could have clients from several states.

Determining whether you need a foreign qualification can get tricky. It’s best to err on the side of caution and consult a startup business professional or use a service like Incfile’s Foreign Qualification service when you are ironing out your business’s growth plans. We can ensure you are legally able to work in other states.

How to File for Foreign Qualification with Incfile

Okay, I’ve realized that I need to file the paperwork for a foreign qualification. How do I go about it? How long does a foreign qualification take?

Much like other aspects of doing business, there is a process to follow and some paperwork that needs to be in order.

When you use Incfile's Foreign Qualification service, here are the steps we'll take on your behalf:

- Searching the state’s name database to ensure it's a compliant business name that's not being used by another company in the state. If you intend on using a different name to designate new locations, you'll also have to apply for a DBA.

- Appointing your selected Registered Agent in each new state of business. Incfile has a Registered Agent service and can act as your agent in any state.

- Filing for Certificate of Authority/Application for Authority. We'll fill out the paperwork for you.

- Paying fees. We'll collect payment from you and send it to your state's authority.

You can expect the entire registration process to take anywhere between 2 to 3 weeks. The fees range from $50 to $350, depending on your state and entity type. For example, New York foreign qualification costs $225, while a California foreign qualification is $100. Incfile's service fee to prepare and file a Foreign Qualification is $149. You can select your entity type, state of formation and state of foreign qualification on our Foreign Qualification page to see your total costs.

Using Incfile's service can eliminate the time-consuming and sometimes confusing process of getting foreign qualified. You can take this gained time back to focus on actually growing your company by closing more sales, meeting clients or hiring the support staff you so need.

Penalties for Failing to File for Foreign Qualification

There’s no easy way to say this — if you fail to file for a foreign qualification (i.e., not have the Certificate of Authority) and continue to operate — you’re jeopardizing all the hard work and time you spent starting and building your business. Yes, it can all go down the drain.

Some other implications of operating illegally in the state include:

- Inability to sue (if you aren’t officially registered in the state, you can’t sue a vendor or client for breach of contract or late payment).

- Fines and fees for not registering. Sometimes, you’d even have to pay interest for the period you were operating in the state without proper registration.

- Payback substantial taxes that could skew your business’s profitability.

- Limited funding options as you can’t apply for loans from banks or other financial institutions.

- Loss of Certificate of Good Standing, which can have other financial repercussions and also impact your incorporation status.

Bottom line — it’s simply not worth the risk to operate without a foreign qualification.

Expanding Your Business with a Foreign Qualification

Getting the right paperwork for your business is one of the obligations of a business owner. Filing for a foreign qualification is an important part of your company’s growth and long-term success. It’s a step you shouldn’t skip.

You could go the DIY route, but remember that each filing will come with additional fees, filing compliances and laws that can consume a lot of your time and energy. Appointing an attorney could potentially strain your budget.

That’s why we recommend working with a professional service that provides foreign qualification offerings and can handle the legal paperwork on your behalf. Incfile’s Foreign Qualification service will not only save you precious time and energy, but it’ll also minimize any filing errors and, overall, lower your stress levels. This affordable plan offloads the burden of keeping your business in compliance and legal, so you can focus on growing your business at lightning speed.