You've got a thriving small business on your hands. You're providing a service to your consumers, and they're thanking you with the one thing that every business needs to succeed — revenue. Your business might even be expanding so quickly that you need to hire someone to assist you in keeping track of it. Perhaps it's time you employ a small business accountant.

A good accountant will guide you through evolving tax laws to ensure you comply and also make sure you never pay more than you need to. The right small business accountant will help you maximize your deductions, file your taxes promptly and provide you with regular financial reports that help you grow. If you're wondering, "How do I choose a small business accountant?" we have the non-negotiable factors to consider when choosing a suitable accountant or CPA for a small business.

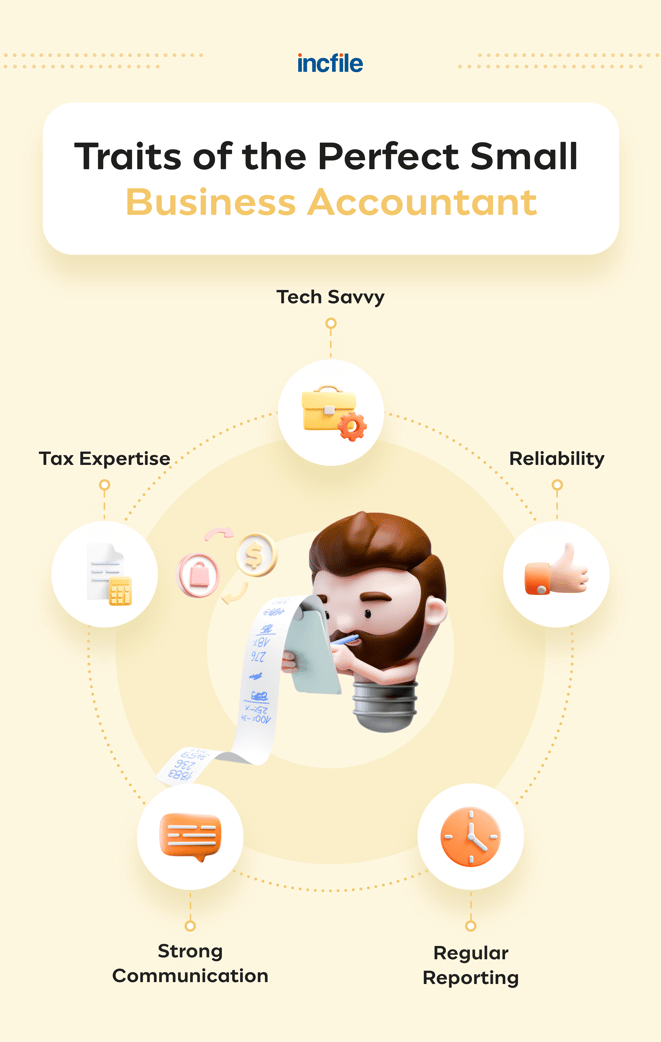

5 Non-Negotiables for a Small Business Accountant

Strong Communication

Accountants have a reputation for poor communication. That’s why finding one who is an open, prompt communicator is so important.

Levon Galstyan, a CPA with the Oak View Law Group, recommends that small business owners find an accountant who can keep open channels of communication with the whole team. “It is ideal if your CPA collaborates with your entire financial staff, including attorneys, financial advisors and bookkeepers,” he says.

And make sure you look for a CPA for your small business who responds promptly over more than one channel of communication. Do you like to receive phone calls, texts, emails or something else? Small business owners may find it frustrating to adjust their own schedules and communication styles to the whims of their hired professionals. In addition, finding ways to streamline the process and make it more efficient through communication preferences can really go a long way toward helping you run your business smoothly.

Tim Yoder, an author and accounting expert with Fit Small Business, recommends finding an accountant who communicates with you according to your preferences. “Life will be easier for you and your accountant if you frequently touch base on issues," he says, "and that often can be done with very short communications that can be texts instead of phone calls or meetings."

Regular Reporting

A good small business accountant will provide financial statements at regular intervals. Some accountants are more transparent about their reporting frequency, while others may not have a formal reporting system in place.

If you find an accountant who isn’t upfront about their reporting schedule, you might want to look elsewhere. Without a system for providing consistent financial reports, you may have to go searching for critical information to provide to investors or for filing taxes, which is inefficient and can cause unnecessary stress.

When Lattice Hudson, owner and business coach with Lattice & Co., hired a CPA, she needed to know how frequently she would receive financial statements upfront. “Frequent communication was critical between my accountant and myself, especially as my firm grew,” she says. “I intended to employ my accountant as a business counselor rather than just for tax advice. As a result, I established expectations regarding the regularity of reporting and contact in advance and hired an accountant that fit my needs.”

Tax Expertise

It might go without saying, but you should be looking for a small business accountant that has extensive tax expertise. Oftentimes a small business owner will hire a bookkeeper to take care of everything, but an accountant with expertise in taxes should really be hired in addition to the bookkeeper.

“Be aware that anyone is allowed to sign a tax return as a paid preparer, regardless of qualifications,” says Yoder. “I highly recommend your tax accountant be a CPA or an Enrolled Agent, which is a person certified as a tax expert by the IRS.”

Galstyan recommends business owners go a step further and look for accountants with an MBA or those who own their own businesses. “Many accountants often become narrow-minded, unable to view their work in its whole and from the perspective of a whole company,” he says. “That is why business owners should prefer accountants with an MBA or who own a successful business. They are aware of the golden rule, which is to maximize value.”

Galstyan also likes for small business owners to find accountants with specialized tax expertise in their specific industries. “Recognizing your industry's tax consequences and operational practices can save your small business thousands of dollars (or more) each year,” he says. “Inquire with your accountant whether he or she has ever worked with a client similar to you and for references with whom you can discuss best practices.”

Tech Savviness

When choosing an accountant for her business, Hudson inquired about the technology and tools they used for accounting services, particularly since she wanted to be able to manage some of the business accounts from her end.

“I was looking for an accountant who uses tools that can be conveniently used in combination with the methods that my business uses on a regular basis,” she says. “Today, the great majority of organizations use online accounting software to simplify their operations, gain real-time insights and cut expenses. So I was searching for an accountant who was familiar with the more prominent accounting software platforms."

Today’s cloud-based bookkeeping software, such as QuickBooks Online, FreshBooks and Xero, allow your accountant to directly access your financial statements from their own computer.

“In order for your accountant to access your books, they generally need the accountant version of whatever software you are using,” recommends Yoder. “It’s crucial that your bookkeeper be familiar with your software-of-choice and can access it remotely through the accountant version."

On the other hand, if you find a bookkeeper you really like, it might be worth changing to whatever software they recommend. As long as you have compatible software and you feel confident in the accountant's comfort with the latest accounting technology and software, you can feel at ease.

“A profession in accounting entails a lot of computations, but it's not all about arithmetic. Accountants must be comfortable using software and other technological tools to perform these computations,” says Galstyan. “Being an expert at making and maintaining spreadsheets and a fast learner whenever it refers to technology might provide you with a significant advantage in the accounting sector.”

Reliability

Reliability is a non-negotiable attribute that you must constantly seek in everyone you hire at your small business, including your accountant. When the risks are high and response times are short, business owners need to work with dependable, trustworthy people they can rely on.

“If an accountant can't provide a perfect list of references, keep looking,” warns Galstyan. “As a small business owner, I'd prefer to see significant corporations that work in the very same industry as myself, or at the very least with the same volume or type of transactions. I wouldn't accept new accountants unless they have prior experience with well-known companies.”

Imagine what would happen if your small business accountant turned out to be unreliable. You might go through the entire year without hearing from them, only to learn in tax season that they dropped the ball. When you start by looking for an accountant with open lines of communication and end with reliability, you have your bases covered. This can help you avoid common pitfalls and set up a system to identify red flags early on, avoiding a scramble in tax season.

Getting Small Business Accounting Help

Get ahead of your accounting needs. At Incfile, we offer complete business accounting and bookkeeping services at a low monthly cost because we understand that small business owners need help and time to ramp up their sales and operations. We can take care of all of your accounting and tax needs without you having to search for the right accountant elsewhere.