Funding can be scary. It's never easy to ask for money, is it? Fortunately, today there are multiple unconventional ways to fund your entrepreneurship dreams — the bank isn't your only option.

Crowdfunding is one of the new, low-risk options for startup owners to explore.

You might be thinking, "Yes, I've heard of crowdfunding, but how can I do this and which site is best to crowdfund my new business?"

You have the questions and we have the answers!

4 Types of Crowdfunding Sites

Crowdfunding is when a company or individual uses a "crowd" to launch their business. Instead of going to one or two major investors or a bank, crowdfunding uses the power of many small donations from a large number of people.

There are four different types of crowdfunding.

- Donation: This works when people donate to a campaign or product without expecting anything in return. Let's say you need money to secure a piece of equipment, people who donate to your campaign commonly do it just out of goodwill and the desire to see your startup succeed.

- Reward: In this setup, the people contributing funds typically get some sort of return — it could be first dibs on a product, free T-shirts for the first 100 contributors or access to a service at a discounted rate.

- Debt: This model of crowdfunding is a form of peer-to-peer (P2P) lending. The "crowd" or group of people gives funds in exchange for repayment of capital and interest over time. These loans typically have lower interest rates, quicker approval times and favorable terms.

- Equity: This last type of crowdfunding option is where the crowd gets equity or stake in a company in exchange for the capital they provide. This is typically used by startups seeking a larger amount of funds.

Can I Crowdfund to Start a New Business?

Yes, you totally can! And here are a few reasons why you might want to explore this funding alternative:

- Accessible for all business types and sizes

- Low-risk, fastest to raise funds

- You can retain complete ownership over your company

- Usually, there are no obligations to pay back the amount if the idea isn't successful

- Minimal, if no, upfront fees

- Ability to get expert or customer feedback on product/idea

- Offers the opportunity to pre-sell a product/concept and get cash rolling in

Which Crowdfunding Platform Is Best for Startups?

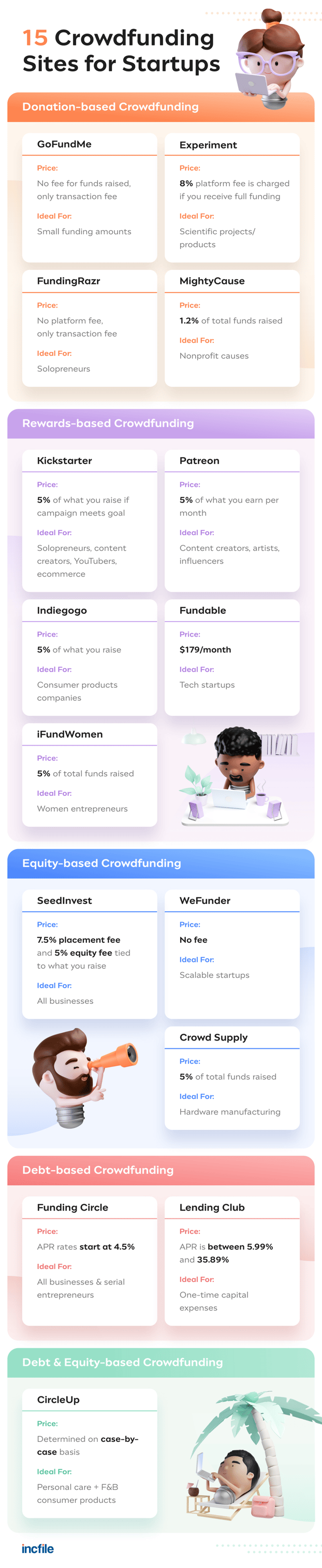

To help you kickstart your business journey, we researched and reviewed the top crowdfunding platforms. So, here we are, presenting our list of 15 of the best, most well-known and used crowdfunding sites for new businesses. No matter what type your small business might be — these platforms will help you achieve your financial goals.

1. Kickstarter - Best Overall Reward-Based Site

The OG of crowdfunding sites is Kickstarter and for good reason, too. More than 20 million people have supported Kickstarter projects since its inception in 2009. This platform is also ideal for content creators like influencers or YouTubers to tap into a large base of donors while offering a unique creation in return. For instance, if you're a designer, you can create a new collection and offer one piece from it as a reward.

However, funding is all-or-nothing, meaning if you don't hit your goal within the stipulated time, all the money will be returned to the respective people.

Fees: Kickstarter charges 5% of the collected funds of a successful project. Processing fees are between 3-5%.

2. GoFundMe - Most Versatile Donation Platform

GoFundMe is a trusted, donation-based crowdfunding site that can be used to fund almost anything, even your new product. Its track record boasts of raising over $5 billion from a pool of 100 million donors and transparent fees — the onus will never fall on your donors to pay fees that keep GoFundMe running. It works best for those seeking smaller amounts ($5,000 - $10,000) to kickstart their small business.

Fees: No fee for funds raised; transaction fees are 2.9% + $0.30

3. IndieGogo - Best for Consumer Product Businesses

IndieGoGo is one of the premier rewards-based platforms; the average amount raised is a stellar $41,634 — the highest average amount of any platform.

It's popular for businesses with tangible products since you'll be able to ship your product (or a working prototype of it) as a reward. The site also enables you to generate publicity for your campaign by integrating it with Meta & Twitter. One perk of Indiegogo is that it offers flexible funding, which means that even if you don't hit your financial goal, you get to keep what you've earned.

Fees: 5% of total funds raised; transaction fee is 3% + 0.20

4. Patreon - Best for Artists, Content Creation Professionals

Podcaster? Blogger? Animator? If you are looking for some funding for your exclusive content, try Patreon — a self-declared crowdfunding site for content creators. How does it work? Your followers can support you through a monthly subscription model, giving you a predictable income stream. In exchange, they will get access to a "recurring reward" — your content.

You can set up multiple subscription tiers so people can select an amount they feel comfortable providing. A new person might be comfortable giving $1/month for your work, while loyal followers wouldn't mind dishing out $10 or $20/month.

Fees: 5% of what you earn per month; transaction fees are 2.9% + $0.30

5. SeedInvest - Best for Equity Crowdfunding

SeedInvest has worked with over 250 early-stage startups. The site will give you access to close to 700,000 investors. To get funding via SeedInvest, you'll need to fill out an application and undergo a pretty stringent due diligence process. SeedInvest has funded startups across all industries — from ecommerce and real estate to hospitality and food and beverage.

Fees: 7.5% placement fee and 5% equity fee tied to what you raise. If the campaign is unsuccessful, there are no fees.

6. WeFunder - Best for Scaleable Businesses

WeFunder has built its name and reputation in the crowdfunding domain by allowing small businesses to start raising funds in under 15 minutes. Doesn't matter if you're thinking of starting a craft brewery or building the next revolutionary solar product, you will be able to solicit funds from more than 150,000 WeFunder investors. You can raise anything between $50,000 to $50 million from investors. Most campaigns take between one and three months to reach their goals.

Another benefit of using WeFunder is that they offer lots of helpful resources for startups, like mentorship, legal document and investor relations assistance.

Fees: No fee; administrative costs are charged to investors

7. Experiment - Best for Scientific Researchers

Experiment is a crowdfunding site solely for scientific discoveries. It has funded over 900 projects and raised $8.9 million since its inception in 2012. If your startup involves a lot of research or will "push the boundaries of knowledge" and you're struggling to get grants, this might be the ideal platform to secure funds.

It's quick to create a profile, and most campaigns run for 30-45 days.

Fees: An 8% platform fee is charged if you receive full funding; transaction fees range from 3-5%

8. Funding Circle - Best for All Businesses & Serial Entrepreneurs

Funding Circle, an online loan provider, has helped business owners get their feet off the ground, buy equipment, expand and even hire the next employee. The platform connects entrepreneurs with a variety of finance options, including SBA loans, lines of credit and cash advances.

Not sure what sort of funding option is right for you? Fill out their six-minute application to get a response in as little as five hours. The site has helped 122,000 small businesses across the world.

Fees: Business loan (APR) rates start at 4.5% + a one-time origination fee.

9. FundRazr - Best for Solopreneurs

FundRazr makes crowdfunding easy, fun and fast. This cloud-based platform is ideal for solopreneurs who need a quick influx of cash to start their business. The platform has helped over 4,000 business owners get the required funds and has an impressive 41.8 percent success rate. Use their Successful Fundraising Guide and create an effective campaign for your cause.

Fees: No platform fee, just third-party processing fees

10. LendingClub - Best for Large, Capital Expenses

LendingClub is a debt-based crowdfunding site where you can secure up to $40,000 in personal loans and $500,000 in small business financing. LendingClub is not a bank — you will get connected with an investor who will decide if they want to loan you the amount or not.

What we like about LendingClub is that you can secure a loan even if you don't have a pristine credit rating. Competitive interest rates and quick approval times makes Lending Club a favorite amongst startups (they also have a 95 percent customer satisfaction rate).

Fees: Annual percentage rate (APR) is between 5.99% and 35.89% + an origination fee of 1% to 6%

11. MightyCause - Best for Social Causes

Looking for an all-in-one platform for a social or nonprofit business, look no further than MightyCause. This platform has funding, donor management and CRM (customer relationship management) capabilities. It also offers one of the lowest rates for nonprofits, charging only 1.2 percent of the amount you raise.

Fees: 1.2% of total funds raised; transaction fee is 2.2% + $0.29

12. Fundable - Best for Tech Startups

Fundable offers two crowdfunding models for budding entrepreneurs — reward-based or equity-based. The platform allows business-to-consumer (B2C) companies to pre-sell products and merchandise for investments up to $50,000.

For startups that need more funding (between $50,000-$10 million) or are business-to-business (B2B), the site also offers equity-based funds from accredited investors.

Fees: Create a free profile, but $179/month to fundraise. For the reward-based model, there is a 3.5% + 30¢ fee per transaction.

13. iFundWomen - Best for Women Entrepeurneurs

Are you a women entrepreneur ready to make your mark but need a little help in terms of finance? iFundWomen might be your answer. This crowdfunding site keeps things simple — it focuses exclusively on the rewards-based model. This site has funded successful investments for fitness instructors, musicians and even mental health care providers.

The best part of iFundWomen is that you get to keep whatever amount you raise, even if you don't meet your goal. The platform also supports business owners by offering a free crowdfunding e-course and small business marketing services to those who sign up.

Fees: 5% of total funds raised; transaction fees are 3-5%

15. Crowd Supply - Best for Hardware Manufacturers

Crowd Supply is a niche crowdfunding site for one who has a manufacturing product in any industry (however, the majority of them are tech-based). The USP (unique selling point) about this portal is that over 90 percent of the campaigns are funded and Crowd Supply even steps in to help with shipping and logistics for 100%-backed projects.

Crowd Supply also provides you with a vibrant supply of engineers who will give you valuable feedback on your product, assist in designing a marketing strategy and even do some copywriting for you, so you have the greatest chance of success.

Fees: 5% of the amount raised; premium services like marketing are priced at 6-15% of funds collected

15. CircleUp - Best for Personal Care + Food & Beverage Consumer Products

Think you might have the next great organic skincare solution? Get your required influx of cash through CircleUp. Over the last several years, CircleUp has supported more than 500 businesses get to market. The company offers a plethora of funding options in the form of loans, credit lines or equity, so you can pick one that best meets your needs.

Top Crowdfunding FAQs Answered

How Do I Start Crowdfunding?

- Identify a crowdfunding site that meets your goals. You can reference our guide below on how to select the right crowdfunding site for your business/product.

- Create a profile for your business on the chosen site. Some websites have an approval process.

- Set up your campaign, funding amount and timeline.

- Publicize your project amongst family and friends, on social media and on your LinkedIn profile. The more people know about your campaign = more chances of hitting your goal.

Can You Crowdfund on Two Sites?

While most crowdfunding platforms don't prohibit you from posting your campaign goals on multiple sites, we don't recommend going this route. Why? Because posting your product or campaign on multiple channels dilutes the messaging and can deter people from contributing.

It can be confusing for contributors to find details about your project. Which site is accurate? How much of the funding goal is achieved? Also consider the effort that will be required of you to update and maintain multiple websites.

Do Crowdfunding Sites Screen the Projects?

While not all crowdfunding platforms screen the projects and campaigns that get submitted, the majority of them do. Why do they do this? Most of the donation and rewards-based sites review proposals because they aim to ensure they are meeting the portal's guidelines and that your reason for seeking funds is legit.

Do Crowdfunding Sites Charge Upfront Fees?

Most crowdfunding portals don't have any upfront fees to create an account and post a project. The way crowdfunding platforms make money is by taking a portion of the money that's raised.

There also might be some credit card/payment processing fees, typically between 3 to 8 percent, that would eat into the amount of money you eventually get. Always read the fine print to get a complete understanding of payment terms before committing to a platform.

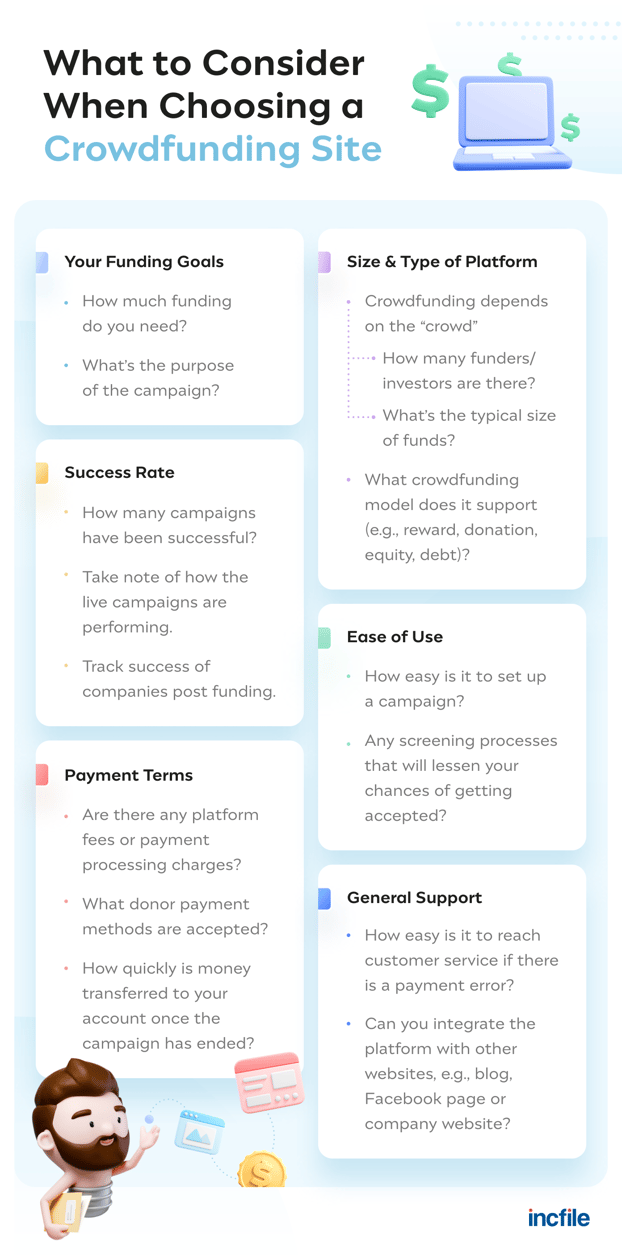

How to Select a Crowdfunding Platform

Every crowdfunding site offers something different. It all comes down to what your financial goals are and what amount you need — are you willing to give your product as a reward or do you prefer giving up equity?

Below are a few other points to remember as you compare various platforms to determine which is the right fit for launching your business.

Crowdfunding — A Worthy Contender to Traditional Finance for Your Startup

Trying to raise money to get your business launched can be nerve-racking. Crowdfunding has given wings to many startups and it might just be the faster and easier way to meet your financial goals. Give our list of 15 crowdfunding sites a try — we're sure you'll find one that speaks to your business's vision and needs.